Estate Planning Attorney MN

Estate planning in MN, can be difficult to think about, but it is made much easier when you hire an experienced law firm to assist you in planning; your estate planning attorney in Minnesota will guide you through the process and know the ins and outs of the legal system that you need to be aware of when figuring out how to leave your belongings to loved ones.

What Does an Estate Planning Lawyer Do?

A law firm that specializes in estate planning will help make sure all of your assets will be passed on to your loved ones when you are no longer around. A lawyer can help you figure out the best way to divide assets and explain all the different options to you so that you can make the right decisions for you and your family. An estate planning lawyer can help you:

- Create a will

- Protect your belongings

- Give property to others

- Reduce the amount of taxes your family members will pay on your estate

- Make a plan in case you are ever involved in an accident that leaves you incapacitated

- Avoid having family members argue about your estate after you have passed

There are many other things that go into estate planning, but these are some of the basics. We will look at all of your concerns and figure out solutions to each of them during a consultation.

Estate planning is not fun, but when you look at everything with a matter-of-fact angle with an attorney it becomes a little easier. The lawyers at Johnston Martineau, PLLP are very experienced in dealing with people of all backgrounds and with all different types of assets that need to be protected. We can help you figure out how to divide them among loved ones and how to make the process go smoothly when the time does come to divide your possessions.

Reasons You Need an Estate Planning Attorney as a Young Adult

You Have a Family

As soon as you get married or have a child, it is time to think about how an estate planning attorney in Minnesota, such as Johnston Martineau PLLP, can help you. There are a number of reasons this is a necessity. When you have children, you want to ensure they are in the best care possible should the unthinkable happen to you. An estate plan provides specific information regarding who is in charge of your children if you and their other parent can no longer care for them.

You Gain Some Wealth

As you begin to earn income, purchase cars, buy homes, and acquire major electronics, furniture, or jewelry, you will need to protect it. This is especially true if you share these items with other people who are not considered to be your next of kin. If you own a home that you share with a domestic partner, for example, you want to ensure that your partner remains in the home should something happen to you. Without it in writing, it will be a much longer and harder process for that to happen. An estate planning attorney in Minnesota can also help you draw up documents that list all of your valuables, such as family heirlooms or electronics, and provide information on who should receive those items in the event of your passing.

You Have Medical Needs

Yes, you are young and healthy right now. Hopefully, you will be for years the come. Unfortunately, though, sometimes the unthinkable happens. Car accidents can leave people unresponsive, cancer diagnoses may leave you needing medical care, and so on. It is always best to be as prepared as possible for the unthinkable. Johnston Martineau PLLP can help you draw up powers of attorney and other healthcare proxies that ensure your medical care is handled the way you want it to be in the event that you cannot handle it alone anymore. This means deciding who determines whether you continue treatment plans, whether you are taken off of life support, and so on. Be sure to choose someone you trust with these decisions.

You Need Someone To Keep You on Your Toes

After you graduate college, things often happen fast. Hiring an estate planning attorney in Minnesota now ensures that you have someone who will check in with you periodically to ask if there have been changes to your needs and whether you require new documentation to be drawn up. One such example is divorce. The grief of a lost relationship often means people forget to update powers of attorney, wills, and more. A lawyer who checks in once or twice a year can remind you of these needs.

When Should You Begin Creating an Estate Plan?

It is never too early to start planning how you want to take care of your friends and family after you are gone. Life is unpredictable, and even if the odds are that you will be around for a long time, it can still bring peace of mind knowing exactly where your assets will be distributed after your passing. By creating a plan for your assets, you can know that no matter what things life throws your way, your family will be protected.

How To Prepare for Your First Estate Planning Attorney Meeting

While people often think estate planning services are strictly for seniors, the truth is that they’re for individuals of various ages who wish to take care of their family and friends after they’ve passed away. So if you’re ready to schedule your first meeting with an estate planning attorney in Minnesota with Johnston Martineau PLLP, here are four ways to prepare for this appointment.

1. Complete Questionnaires

Written or verbal questionnaires enable your attorney to learn about you, your family and your lifestyle. If your estate planning attorney in Minnesota provides you with a questionnaire before you meet in person, complete it to the best of your ability. Your commitment to providing correct, up-to-date information not only benefits you and your family but also saves you and your attorney time for more discussion and decision-making.

2. Collect and Organize Your Financial Records

While your attorney may not ask you to complete this task for your initial meeting, you’ll need to furnish these all-important documents at some early point in your estate planning process. Bank and investment account documents are the foundation of most requested financial records, including checking, savings, IRA and brokerage statements.

It would help if you also furnish divorce or premarital agreements and any other related contracts to your lawyer. No matter the estate plan you and your lawyer agree on, it must comply with existing legally binding agreements and contracts.

3. Consider Your Assets and Agents

While your Johnston Martineau PLLP attorney will guide you in a discussion about how to distribute your assets and who you want to act as your agents if you are unable to make decisions, it’s a good idea to start thinking about these ideas ahead of time. Many people choose to talk about this with a partner or loved one to gain clarity. No matter how you prefer to proceed, write down your ideas and questions to share with your attorney.

4. Write Down Your Questions

Sometimes it’s difficult to think of or articulate questions during your first meeting, especially if estate planning is a new concept to you. So before you meet with your attorney, take some time to jot down your thoughts, questions and curiosities. Having a list to refer to can help you maximize your time with your attorney. You may also choose to take notes during your meeting so that you can ask for clarifications or definitions before it comes to a close.

Contact Johnston Martineau, PLLP Today for Your Estate Planning Needs

Contact an estate planning attorney in Minnesota from Johnston Martineau, PLLP today to see how we can begin working with you on your will. Our experienced attorneys will make sure you have all of the important information that involves planning an estate and that your family will be taken care of, even after you are gone. We can answer all of your questions and find solutions to any concerns you have about how you want your assets to be distributed. Call today to get started.

As we grow older, we have more questions about our future – and an estate planning attorney in Minnesota can provide all the answers you need. Once we start feeling our age, we begin to wonder about our family, especially how we can best look after them after we’re gone. It’s a sobering thought, but it’s better to have a plan than to leave things to chance.

You may be wondering about who will care for your children, your grandchildren, or even your great-grandchildren after your death. And you may also be wondering how you can care for your family if you start losing your ability to care for yourself. There are many uncertainties when planning out your future, but you can leave behind proper instructions for your loved ones to follow after your death.

An estate planning attorney in MN, can help you create a will, but they can also help you plan for any emergency that would cause you to be incapacitated. While you might only think of an estate planning attorney in Minnesota as a resource for planning for after your death, they can help plan for any events that could lead to your death in the first place.

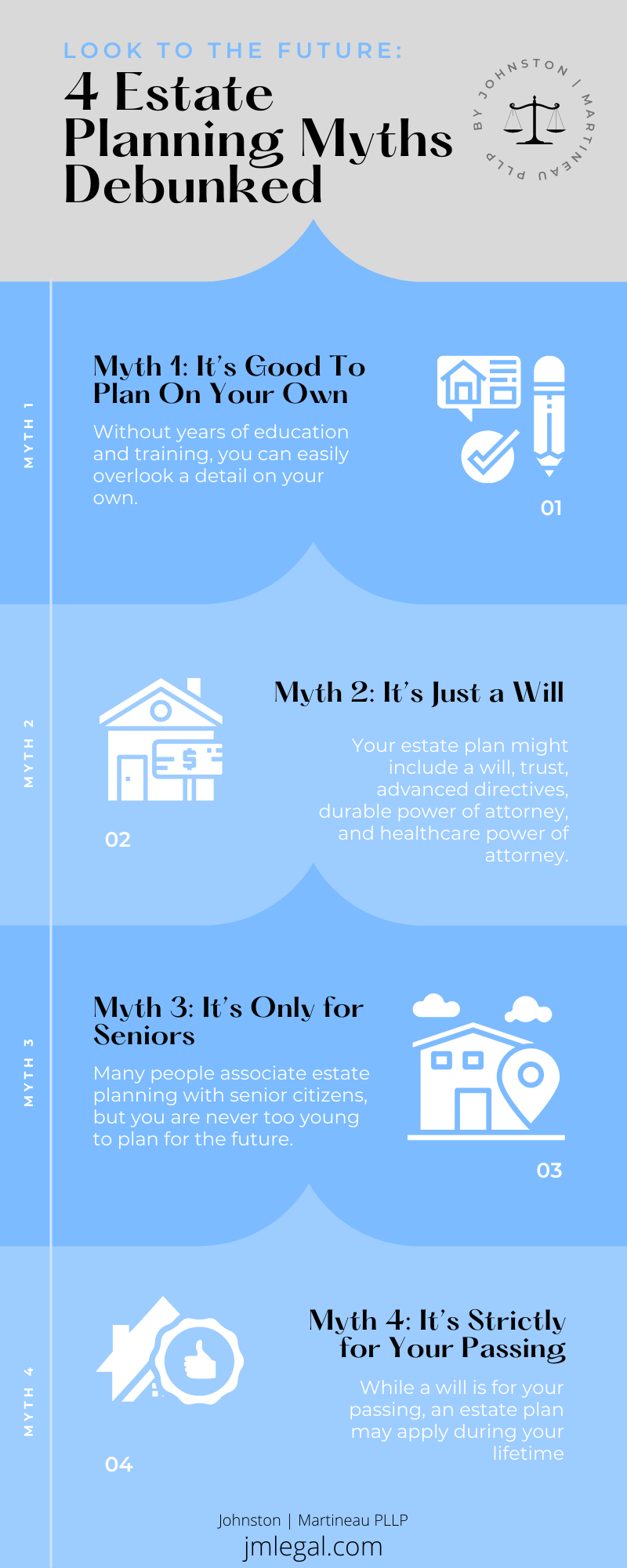

Look To the Future: 4 Estate Planning Myths Debunked

It can be easy to delay or overlook planning your estate. Not only do many people view estate planning as an unpleasant subject, but it’s also a topic that has many misconceptions. The reality is that prepping for your future, protecting your loved ones, and organizing your assets is smart. A little time can help you debunk common myths about estate planning.

Myth 1: It’s Good To Plan On Your Own

Just because you can do something, it doesn’t mean that you should. Do it yourself planning tools have a hard time competing with an estate planning attorney in Minnesota. Without years of education and training, you can easily overlook a detail on your own. The probability of errors increases if you have a complex situation like multiple properties, blended families, or more than one marriage. Experienced attorneys like Johnston Martineau PLLP can give you peace of mind that your affairs are in order correctly.

Myth 2: It’s Only for Seniors

Many people associate estate planning with senior citizens, but you are never too young to plan for the future. Young individuals may have children, pets, houses, vehicles, and investments. Unfortunately, accidents and unexpected illnesses can rear their ugly heads at any time. An estate planning attorney in Minnesota can help you rest easy knowing your assets and heirs are protected.

Myth: It’s a One Time Process

Planning your estate is not something you do once and then forget about, especially if you make your plan early in life. From the number of children that you have to your marital status and owned properties to investments, you will likely go through some substantial changes over the years. Each time you pass a major mile marker in life, you should update your estate plan. An outdated plan will leave your loved ones with inadequate directions.

Myth 3: It’s Just a Will

Meeting with an estate planning attorney in Minnesota may help you understand the differences between will planning and estate planning. A last will and testament dictates matters like who will become guardian to your children and where you want your assets will go after you pass. On the other hand, estate planning covers a broader more complex sphere. Your estate plan might include a will, trust, advanced directives, durable power of attorney, and healthcare power of attorney.

Myth 4: It’s Strictly for Your Passing

While a will is for your passing, an estate plan may apply during your lifetime. An estate planning attorney in Minnesota can assist you with appointing a power of attorney to handle your affairs if you become incapacitated. Incapacitation most often occurs from an injury or neurodegenerative diseases. Your power of attorney will handle medical, legal, and personal matters if you are unfit. Be sure to select someone trustworthy and responsible.

If these debunked myths have changed your perspective, you may want to talk with Johnston Martineau PLLP. You may be able to rest easier knowing you, your loved ones, and your assets are prepared for the future.

Durable Power of Attorney

When someone is incapacitated, they need a trusted individual to make decisions on their behalf. A power of attorney is a document that legally entrusts this responsibility. An estate planning lawyer can help you choose who would be best suited for the job. It can be overwhelming, but if you choose the right person to manage your affairs, you can be confident that they’ll make the right decisions and look after your loved ones and your assets.

A durable power of attorney is a power of attorney that goes into effect when you are deemed unable to care for yourself. If for any reason you’re no longer able to handle your personal, financial, or legal matters, the individual with a durable power of attorney will take over. This is an important consideration if your family has a history of neurodegenerative diseases, such as Alzheimer’s or dementia.

Guardianship

A durable power of attorney is a great way to make sure your estate is handled if you’re no longer able to do so yourself. But an estate isn’t everything: You have children, grandchildren, and other relatives that may have been relying on you for anything from shelter to financial support. It’s important to make sure they’re looked after as well, and that’s what makes guardianship so necessary.

A guardian is an individual that is named to take care of any dependents. This can include children, elderly relatives, and adults with disabilities. There are two different types of guardians: a guardian of the person takes care of an individual (or multiple) people named in the will; a guardian of the estate handles finances connected to your estate. In both cases, appointing a competent guardian that you can trust means less uncertainty about your own future and a better future for your family.

Choosing The Right Guardian for Your Minor Children

If you have minor children, choosing their guardian if you pass away is possibly one of the most important aspects of estate planning. Perhaps you have many great family members and think it does not matter if you assign a guardian or not because any of them will be great. Or, you may have certain family members you do not want to have guardianship over your children. In either case, it is always best to sit down and consider who may share the same parenting goals as you and who would raise your children in a loving home.

What should you consider when choosing a guardian?

When you are choosing who you want to be the guardian of your children, there are a few things you should keep in mind, which are listed below. Moreover, the reason why it is necessary to keep various aspects in mind, is to ensure that one is not looking at guardians’ situations, from a black and white perspective.

What are some potential negatives, when it comes to trying to choose a guardian?

One of the negatives that might happen when looking to choose a guardian, is conflict among children. When choosing a guardian for children, one of the best ways to ensure that there is communication on their end, is by discussing why a guardian is being chosen, what that would entail, etc. This can cause conflict, in that children may have different viewpoints, in relation to why a guardian is needed. This is why communication is important.

Why should people consider, when choosing a guardian?

The reason why people should consider carefully when choosing a guardian, is because they should choose wisely, according to someone that could fit their needs the most For example; let’s say that when it comes to choosing a guardian, one wants to focus on estate aspects, that focus on securing financial issues. In cases like this, it would be best to choose a guardian that specializes in financial security.

Their location.

Location does not necessarily have to be a deal-breaker, but it can be important when it comes to raising your children. You may not want your children to move all the way across the country. Or, perhaps you want your children to live with someone who will ensure they see both sides of the family often.

Their age.

For many people who had great upbringings, they may think they will name their parents as the guardians. However, you want to consider that you want the guardians you name to be able to raise them and grow up with them. It is important to remember that your parents, however loving, may have medical issues or may not be physically capable of raising your children.

Their morals and beliefs.

This is another important aspect when it comes to what kind of home your children should be raised in. Consider your own political, moral, and religious choices and then think about which family members may share those beliefs. If you would be uncomfortable with certain family members raising your children, naming a guardian who will raise them in a similar household to yours is paramount.

Do I need an alternate guardian?

It is always best to have multiple people in mind and backup options. In the event that your primary guardian chooses not to accept the position, they become incapacitated, or pass away, you want to know that someone else will be able to step in and fill this role. While you are not required to have a second option listed, it may give you peace of mind as you navigate the estate planning process.

Why is it important to have an alternate guardian?

One of the reasons why one may consider the importance of having an alternate guardian, is because plans change. Moreover, different guardians may have different specific goals in mind. An example of this, would be a financial situation, in which a guardian that mainly focuses on estate, would be beneficiary.

Reach Out to an Estate Planning Lawyer Today

Planning for your future can be intimidating, but you don’t need to do it alone. With the right legal counsel, you can draft a durable power of attorney and provide instructions for guardianship you can trust. Reach out to Johnston Martineau, PLLP today, and see how an estate planning attorney in Minnesota can help you and your family.

An estate planning attorney in Minnesota can also help clients set up what is known as a “living trust.” The purpose of a trust is to manage the distribution of a person’s assets, and a living (intervivos) trust is made when the owner of the assets is still alive. Living trusts can be revocable or irrevocable.

The owner of the assets is also known as the grantor or the settlor. A beneficiary is an entity that benefits from the trust and can be a person or an organization. A trust can have more than one beneficiary. The trustee manages the assets. A trustee can be a person chosen by the owner, a financial services professional, or a trust management company.

The most common form of living trust is a revocable living trust. Assets are placed in the trust, but the owner of the assets can make changes to the trust or even dissolve it. Income from the trust is generally paid to or controlled by the owner of the assets, and the assets are distributed to the beneficiary or beneficiaries after the owner’s death.

The main advantage of a revocable living trust is that it eliminates the need for probate, although you will still need a will. This protects the privacy of the owner and the beneficiaries, and it is a much quicker and easier process.

The main disadvantage is that because the owner still maintains control of the assets in the trust, they may be ineligible for certain medical assistance programs. A revocable trust is generally neutral in terms of taxes, offering neither advantages or disadvantages. A good estate planning attorney in Minnesota, such as those at Johnston Martineau, PLLP, will be able to clarify this for you.

Other kinds of trusts that you may want to explore with your legal advisors include:

After-death (testamentary) trust:

A testamentary trust is created by the owner’s last will and testament. Assets pass into the trust and are managed by the trustee for a specified time period, such as when a minor child reaches the age of majority or another designated age.

Irrevocable living trust:

The owner of the assets cannot dissolve or alter the trust plan, and may not even be able to control the assets in the trust. This kind of trust does offer tax advantages.

Bypass trust:

When one spouse dies, their assets are transferred into a trust managed (usually) by the other spouse. There are tax advantages to this kind of trust.

Life insurance trust: The trust is named as the beneficiary of the owner’s life insurance policy. This can make an estate easier to administer.

Charitable trust:

This is often used for assets such as property, art, or other tangible assets. The owner can enjoy the use of the assets during their lifetime and then they pass to the designated charity upon the owner’s death. The estate will realize tax advantages.

“Spendthrift” trust:

The assets will continue to be managed by the trustee and the beneficiary will receive regular distributions, either as an allowance or upon designated milestones.

If you would like to learn more about how a trust can work for you, reach out today to a knowledgeable and helpful estate planning attorney in Minnesota. We’re here for you at Johnston Martineau, PLLP.

Why Young Adults Need an Estate Plan

Many people in their 20s do not give much thought to estate planning. They might assume that they will live a long time and are too young to establish an estate plan. However, once you become an adult, it is never too early to start thinking about estate planning. Here are a few reasons why young adults need to establish an estate plan as soon as possible.

Young adults acquire assets. People can begin acquiring assets at a pretty young age. After they start working their first full-time job, they may purchase a vehicle, furniture, jewelry and other assets. Some may even purchase their first home at a young age. These assets need protection in case they should die unexpectedly.

Young adults may have children or pets. There are many young adults who are responsible for others. They might already have children of their own or a pet. If they should die suddenly, they want to ensure their children and pets are looked after. This is another good reason to have a proper estate plan in place. Young people can appoint a guardian for their children and pets who will make sure they get their needs met.

Young adults can become incapacitated. Severe health issues do not affect the elderly. Young people can too become incapacitated and can’t make important decisions on their own. That is why it is important for them to include a power of attorney in their estate planning documents. The legal document allows a person to designate someone to make decisions about their financial and health matters for them.

Young adults may want to give assets to friends or charities. When a person dies without a proper estate plan, the law dictates who will receive that person’s assets. For example, your property may go to your parents or spouse. If you want to give your assets to friends or a charity, it is important to enlist the help of an estate planning attorney in Minnesota promptly.

Young adults may have an inheritance.

Some young people may have inheritances and these inheritances may be held in a trust. They might not even see them as assets. However, an inheritance is a major asset and should be protected. One of the biggest reasons why is because people will sometimes try to take advantage of individuals, and aspects pertaining to inheritances are no exception to this. Moreover, you likely want your surviving family members to get the inheritance should you die unexpectedly.